Exclusive: ChatGPT data from Sensor Tower shows big shifts

The data explains why the GPT 5 launch emphasized coding so much

This is the first “scoop” that I’ve had in my year as a sort of journalist. As I teased over the past few weeks, I’ve been working with Sensor Tower Labs to obtain a data set that has never been published before. The data draws on a corpus of roughly 30 million real ChatGPT chats collected between January and June 2025 from their panel.1

I published the full data and analysis in a Bain Brief this morning. I strongly encourage you to click through and read the whole thing.

Below is a preview of a few of the most interesting pieces of data. I’ll get into GPT 5 in more detail next week, but the launch video highlighted several trends that we see clearly in the data.

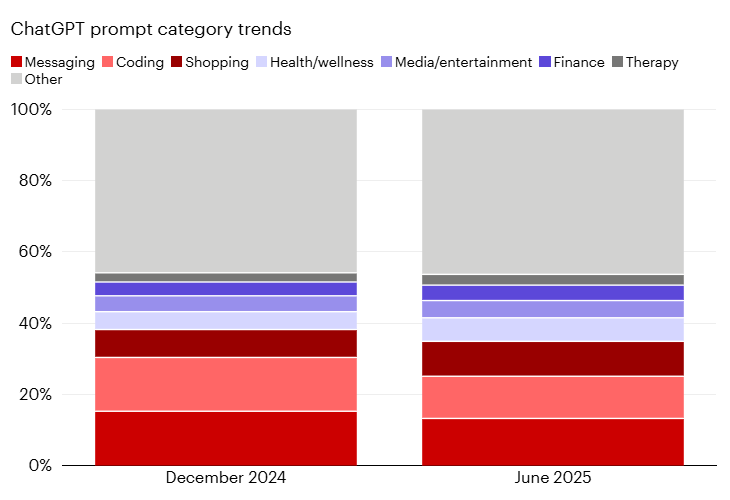

Take a look at the chart below around what people use ChatGPT for:

I see several interesting trends. Most important is that shopping has gone from 7.8% of searches to 9.8%. That’s a 25% increase on top of a 70% increase that we’re seeing in total prompts. That means that the number of ChatGPT queries around shopping has doubled between January and June. That’s a big deal for any company that counts on search for people to find their product. Optimizing content for ChatGPT and Perplexity, AI Optimization (AIO), is no longer optional for B2B and B2C brands.

Also, I was interested to see the big decline in people asking about coding (15.1% to 11.9%). One possibility is that coding was one of the earliest applications, so there’s less growth. However, I suspect part of what’s driving this is that programmers are using either coding assistant tools like Cursor or vibe-coding tools like V0, Replit, and Loveable. Until yesterday, these tools were powered by Anthropic’s Claude Code, but part of the GPT 5 announcement was that Cursor will be using GPT 5 as the default model. A huge part of the launch was focused on coding, so I think they are trying to make up ground with the new model.

Fascinating as well to see the growth in healthcare. Anecdotally, I’ve heard of many patients using ChatGPT to understand test results, etc. During the launch, OpenAI also highlighted healthcare, including a moving story about a woman with cancer who used ChatGPT to evaluate treatment options. Sam Altman specifically mentioned that the model was optimized for healthcare, which makes sense given that it is growing fast.

People are clicking

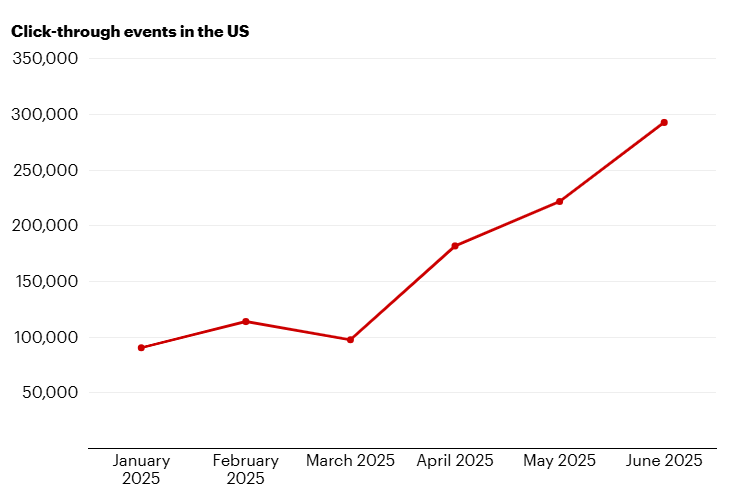

OpenAI has been exposing more live links in answers over time, and users are learning to click on them. Sensor Tower counts a “clickthrough event” every time a panelist taps a link surfaced by ChatGPT. US clickthroughs2 tripled—from ~100K in March to ~300K in June. That implies a clickthrough rate that went from 2.2% to 5.7%.

I don’t have the cross-cut on where people who were shopping clicked. But, the implication that people are more willing to click out, and that it’s changed a lot in the past few months is interesting. It strongly implies that people are using ChatGPT not just for general recommendations but also to find links to specific products or content. Look at this curve:

If you run a content site or an online shop, in addition to getting referenced, you may also need to make sure you are properly linked to maximize the AIO impact.

What now?

ChatGPT is growing rapidly, so it’s hard to know where the ceiling is, but in the short-term companies should be thinking about how to optimize for AIO. Essentially, companies should be testing to see what approaches work to get ChatGPT (and other bots) to find their content. You can find my earlier thoughts on this here and here.

Investors should be looking carefully at companies that rely on search as a primary discovery channel. This could be the opportunity to leapfrog the competition by investing early in this space… or the business could face setbacks if competitors beat them to it. In the future ChatGPT, Perplexity, etc., could also include ads or sponsored content in the results, which could create a more familiar situation for influencing potential customers.

Investors should also think hard about advertising-funded businesses. Will ChatGPT mean fewer visits to websites as it pulls in the relevant content, which reduces ad-traffic, or will there be a new business model where content creators are compensated when a bot pulls in their information?

Anyway, it’s an exciting time to be in business. Feel free to add thoughts in the comments based your own interpretations of the data, and do check out the Bain Brief for a few more interesting data points.

Methodology: Sensor Tower operates a panel of opt‑in Android and iOS users who run its own utility apps (AdBlock Mobile, Phone Guardian, StayFree, Friendly, and others). Those apps funnel more than 100 million on‑device events per day into Sensor Tower’s data‑science stack, which has been training for eight‑plus years and retains roughly 50% of its U.S. panel thirty days out. For the AI‑specific feed, Sensor Tower flags every time a panelist opens ChatGPT on mobile or web, grabs the time‑stamp, the anonymised prompt text, the high‑level topic the model assigns to that prompt, and any outbound links the user follows. All personally identifiable information is stripped out, and only aggregated data make it into the final tables used in this article.

I only have US clickthrough data

Great article! I’m curious — when GPT click-throughs rise, how do you determine whether that’s more of a validation step vs. genuine engagement with useful links?